Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

Saving for retirement is easier than most people think — as long as you get two things right

Reprinted courtesy of MarketWatch.com

Published: May 15, 2024

To read the original article click here

I hear lots of people, young, old and in-between, complaining that they don’t see how they’ll ever be able to afford to retire.

In fact, saving for retirement is easier than most people think, so long as you get just two things right:

- Start setting money aside, the sooner the better.

- Pay a lot of attention to where you invest that money.

This is the fifth installment of a series of articles I’m calling Boot Camp for Investors 2024. My aim is to give you the most important information and tools you could get from a good financial adviser.

To recap, the first article in Boot Camp 2024 demonstrated that over the past 96 years, investors were far better off in stocks than in bonds.

In the second installment I showed how diversification, even small changes in the makeup of your stock portfolio, can give you millions more dollars in retirement.

The third installment showed historical returns and risks of a variety of combinations of equity asset classes.

And the fourth discussed how to use fixed-income funds to limit the amount of risk you take.

This discussion is about getting started. The good news: you don’t have to wait until you have saved up whatever you regard as a lot of money.

We’ll look at what you could have accomplished, starting in 1970, if you had a job and started setting aside a bit more than $20 a week — $88.33 a month to be exact — which adds up to $1,000 a year.

I also will assume you increased your savings by 3% every year.

Here’s a very useful — and unconventional — way to think about this: You are essentially starting a business and you have just one partner: the stock market (represented by the S&P 500 SPX ).

Your job is simple: fund the business by regularly adding capital. Your partner’s job (the market’s job, in other words) is to make that capital grow big enough so you can retire comfortably.

That will take lots of time, and nothing is guaranteed. But your business partner has an extremely high long-term success rate, so long as his partners (investors) do their job and let him (the market) do his.

We’ll see how this works by looking at the capital you contribute and how your balance could grow over time. On my website you can find a table showing this for every year, 1970 through 2023.

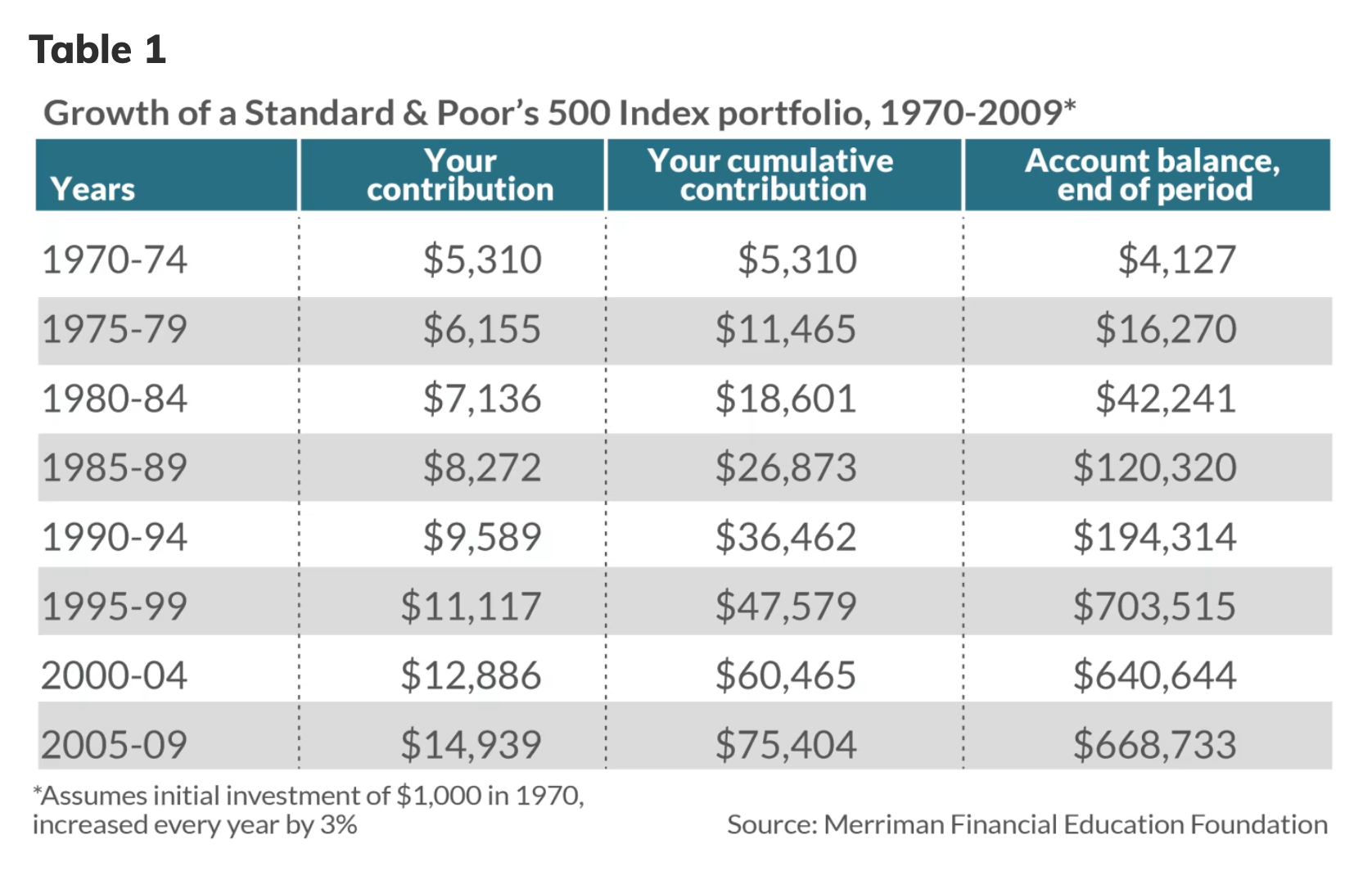

But to make it easier, and for space reasons here, I’ve condensed the data into blocks of five years. For every five-year period, you’ll see how much you contributed, your total contributions to date, and the end-of-year value of your account.

This business partnership requires a good deal of faith. But once you get past the early years, you’ll see the payoff.

After 30 years, at the end of 1999, all the money you put in amounted to mere peanuts compared with what your partner had added.

At the end of 1999, after 30 years of this partnership, you had put in less than $50,000, and your partner had added more than $650,000!

You might have said to yourself: Holy cow! What could go wrong?

The answer is in the bottom two lines. Even though you added $27,825 from 2000 through 2009, your account was worth less at the end of the decade than at the start.

At that point, even though your business partner had multiplied your total contributions by about 8.9 times, you could have jumped ship.

But if instead you kept the faith and continued your contributions, by the end of 2015, your account balance was $1.4 million. By 2020, it was $2.9 million; and it ended 2023 worth $3.9 million.

Still, that decade from 2000 through 2009 was a shocker. You could have been forgiven if you looked around for a new business partner.

That “second partner” was right there the whole time: U.S. small-cap value stocks.

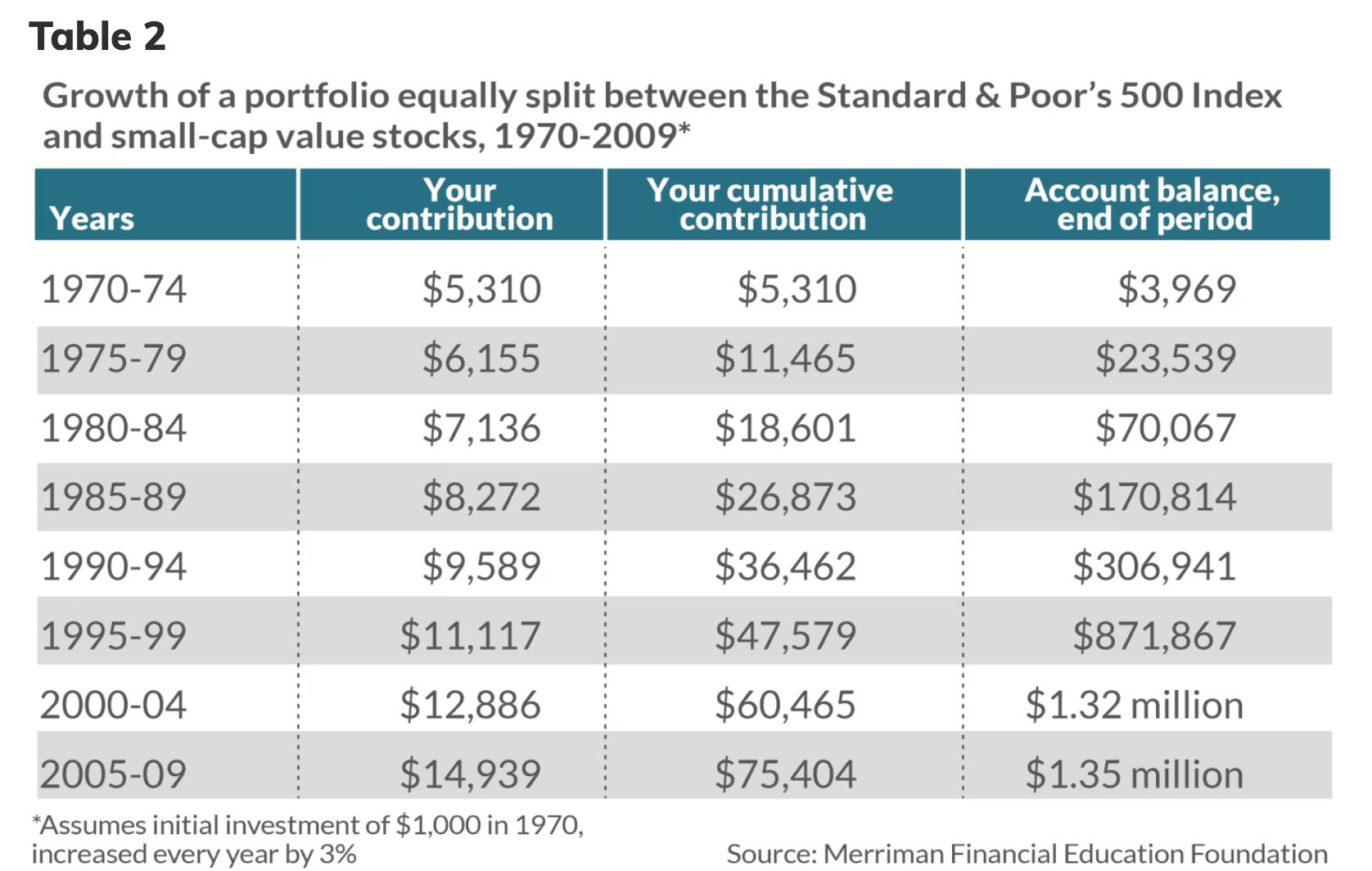

Imagine that in 1970 you had carried out the exact same plan for contributions, with only one difference: You had split your money 50/50 between the S&P 500 and small-cap value stocks.

This is what I call the 2-Fund Strategy, and Table 2 below — identical to Table 1 above, except for the right-hand column — shows what would have happened.

By the end of 2015, this two-fund portfolio was worth $2.8 million (compared with just $1.4 million in the S&P 500 alone); by 2020, $4.8 million (compared with $2.9 million); and by the end of 2023, $7.1 million (compared with $3.9 million).

Every dime of that additional money came from simply adding an additional mutual fund. That’s why carefully choosing your investments is so important.

Read more about diversification in Boot Camp installment part 2

Let’s look again at that disappointing decade, 2000 through 2009. While the S&P 500 portfolio lost $34,782 (despite your additional $27,825 investments), the 2-Fund Strategy grew by nearly half a million dollars. At the end of the decade, it was worth twice as much as the S&P 500 portfolio.

You can track every year of these two portfolios using the far-right columns of the full table on my website.

Every business day, millions of people engage in the business partnership I have described, as they regularly add to their long-term savings.

Although the relationship is indirect, these investors own parts of hundreds (and in many cases thousands) of real-world companies.

Every day, employees of those companies show up for work, managers figure out how to profit from that work, and executives plot to make sure Wall Street (investors, in other words) gets a share of those profits. All we have to do is keep adding a bit of capital now and then — and be patient.

We’ve seen that it’s not always an easy ride for investors. And the same is true for the people running those companies.

When business is booming, it can be hard to keep up with demand. Bad times can mean difficult decisions that involve laying people off, closing plants, ditching new initiatives.

As investors, our job is to keep our focus on the big picture and the long term. If we do our job well, the payoff can be huge.

Take another look at Table 2. If you had followed this business plan for 35 years, you could have retired at the end of 2004 and funded your first year of retirement with a 5% withdrawal.

That single year’s payout was worth more than all the money you had contributed.

This is a big topic, and to help you sort it out, I’ve recorded a podcast and a video in which I’ll walk you through the major points about saving money for retirement.

In the next two installments of this Boot Camp series, we’ll discuss ways to take money out of your portfolio in your retirement years.

Do you have questions about retirement, Social Security, where to live or how to afford it at all? We want to hear from you. Join the conversation in our Facebook community: Retire Better with MarketWatch.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.