Best-in-Class ETF Recommendations

(Updated February 2025)

By Chris Pedersen

Video- Best-in-Class ETF 2025 Recommendations

What are the best ETFs to use to implement our recommended portfolios?

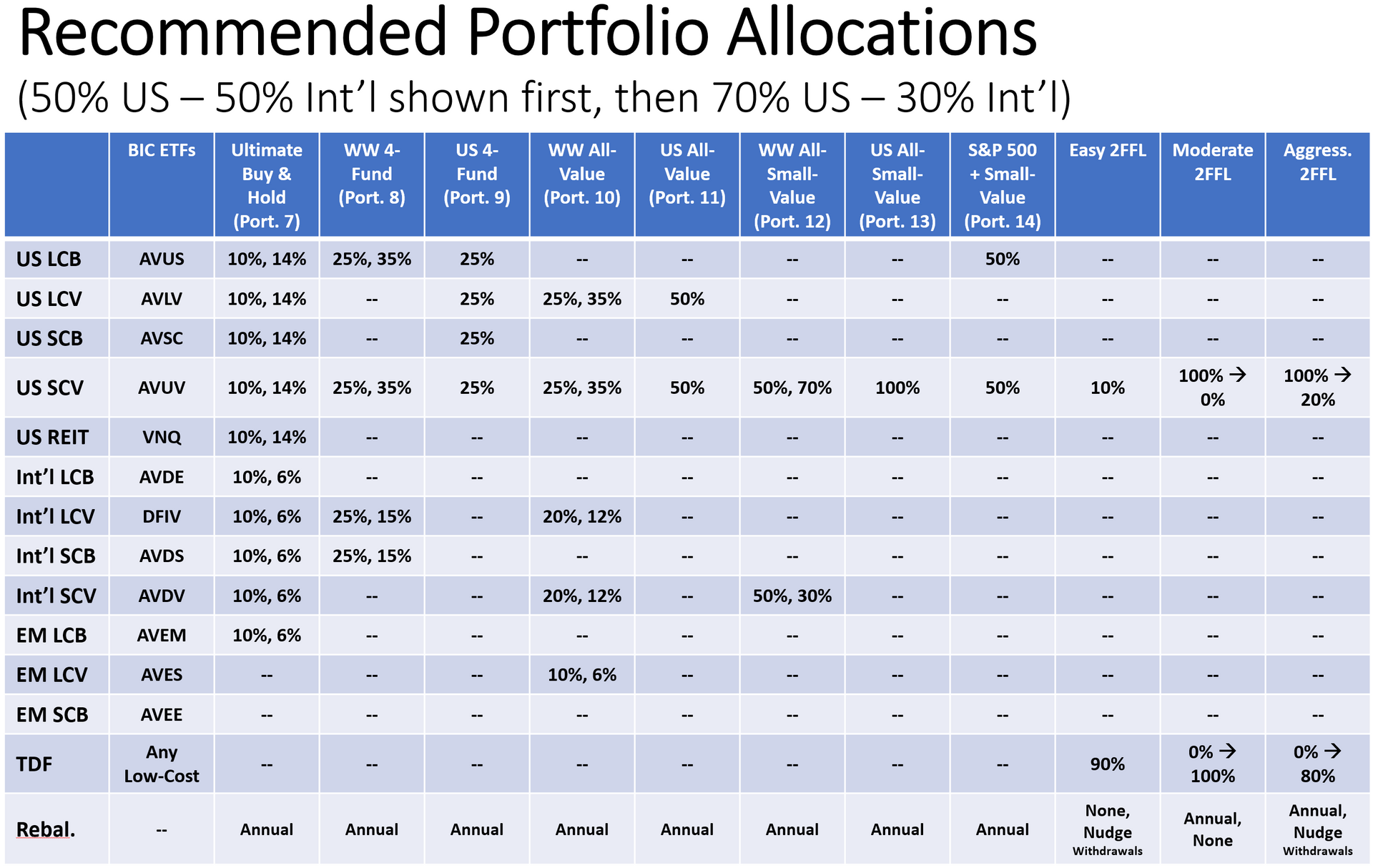

Whatever asset allocation you choose, you’ll also need to select particular funds to invest in. This article provides a set of recommendations to simplify that process. We’ve also updated the

Portfolio Configurator and

Merriman Aggressive TD Glidepath Asset Allocation Calculator to reflect these new recommendations.

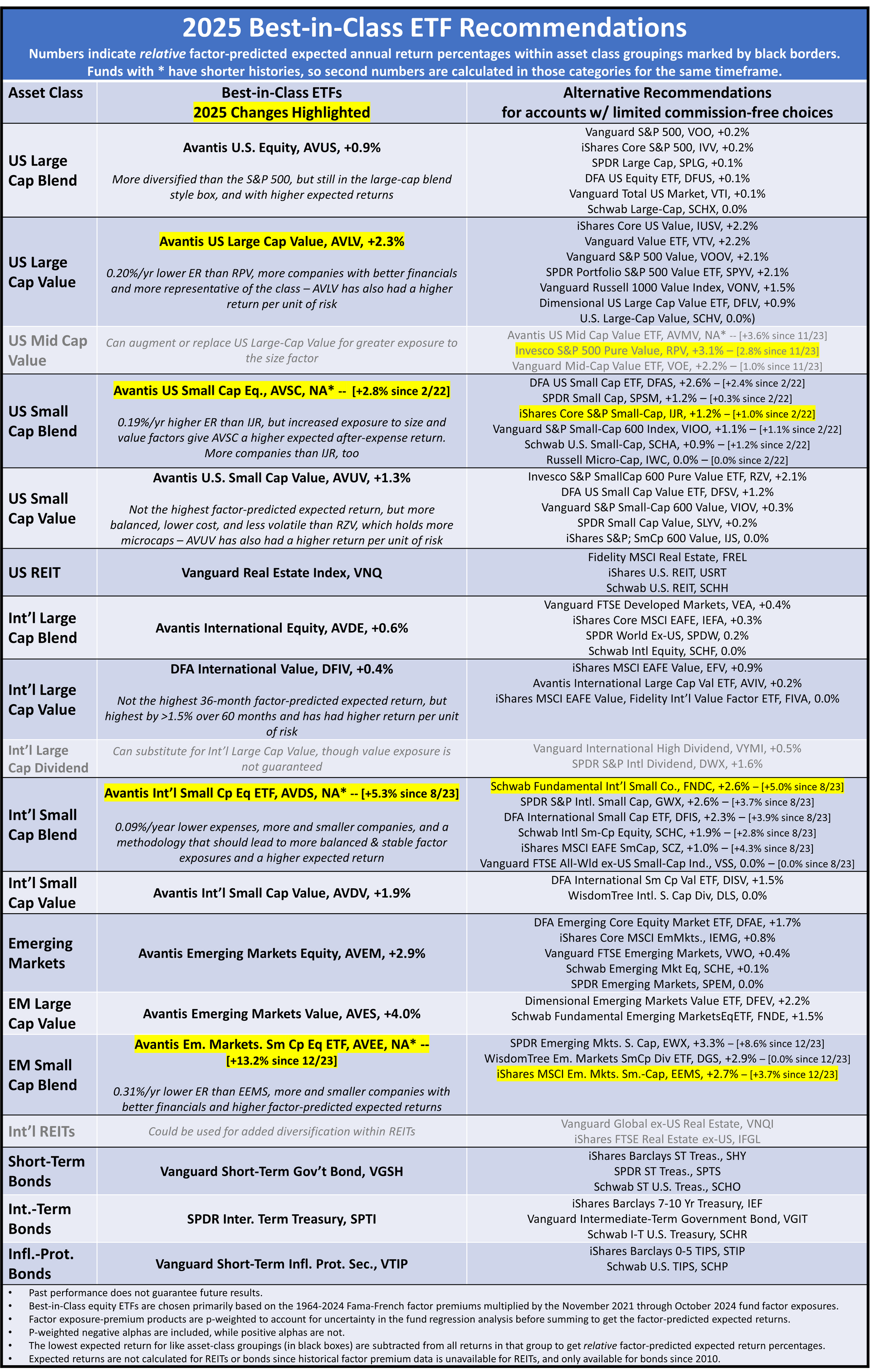

What do we mean by “best?” Keeping expenses low is a priority, but our portfolios are based on academic research that says there have been higher returns in smaller and more value-oriented equities. Those higher returns have come with higher volatility, but combining several different asset classes that don’t always move together makes a higher expected return per unit of risk possible. We look for low-cost, broadly diversified ETFs in each asset class that consistently represent the class and provide exposure to the factors that drive higher expected returns. After screening thousands and analyzing hundreds of ETFs, these are our new best-in-class recommendations and a set of alternatives for those who don’t have access to the best-in-class choices.

There are four fund changes this year and two changes in how we communicate our recommendations.

- Two Communication Changes:

- This year, we include relative factor-predicted expected annual returns for each fund in each asset class group. A +1% difference means a fund has a 1%/year higher expected return than the fund with the lowest expected return in that category. This should help investors decide whether or not it’s likely to be worth changing from one fund to another if taxes or expenses are involved.

- The second communication change is to add the US Mid-Cap Value asset class. This class better characterizes our previously recommended Large-Cap Value fund (RPV). By listing it, we’re now giving investors the choice to tilt a little more to small and value for the higher expected returns or to stick with a Large-Cap Value fund for consistency with our backtests. It also highlights other, potentially more attractive, US Mid-Cap Value funds, such as Avantis’ AVMV.

- Four fund Changes

- The Avantis US Large Cap Value (AVLV) replaces the Invesco S&P 500 Pure Value ETF (RPV) for US Large-Cap Value. This lowers the expense ratio by 0.20% and fits the category better. Since RPV is more accurately described as a mid-cap value ETF, we’ve listed it alongside other mid-cap value ETFs that investors could use instead of large-cap value to get a higher expected return from greater exposure to small and value companies. Investors willing to tolerate more volatility for the added size exposure and higher expected returns may still choose to use it.

- The Avantis US Small Cap Equity ETF (AVSC) replaces the iShares Core S&P Small-Cap ETF (IJR) for US Small-Cap Blend. The reason is that AVSC has a 1.8 %/yr higher expected return. The expense ratio is higher by 0.19%, but the improved exposure to small and value factors leads to higher expected after-expense returns.

- The Avantis Int’l Small Cp Eq ETF (AVDS) replaces the Schwab Fundamental Int’l Small Co. (FNDC) ETF for International Small-Cap Blend. The Avantis fund has 0.09 %/year lower expenses, more companies, and a methodology that should lead to more balanced & stable factor exposures and a higher expected return.

- The Avantis Emerging Markets Small Cap Equities ETF (AVEE) replaces the iShares MSCI Emerging Markets Small-Cap ETF (EEMS) for Emerging Markets Small Cap Blend. Although it’s only been available since December of 2023, it has a significantly higher factor-predicted expected return over that timeframe. It also has a portfolio with more companies of smaller average size and better financials with a 0.31% lower expense ratio.

Should you switch to the new recommendations?

This is something only you can decide. If your funds are in taxable accounts, you should consider the tax implications of selling the old funds vs. the potential benefits of the new ones. If your funds are in tax-deferred accounts, the taxes don’t matter, but your confidence in the recommendations does. If you believe the new recommendations will serve you better based on the rationale given and any additional research you do, then go ahead and switch. Ultimately, it’s probably more important to have an investment strategy you believe in and can stick with than having the ideal funds.

Ten out of eleven of your equity fund recommendations are for Avantis funds – are you following the data or unfairly biased towards Avantis?

I’m following the data and making even more of it visible!

I’m a little surprised that so many of our recommendations are for Avantis Funds, but in a way, it makes sense. Avantis’ roots are in the same academic research that led to the creation of our portfolios. They were pioneers in bringing that methodology, which had been pioneered in Mutual funds at DFA, to ETFs, and have remained committed to the same kind of discipline and rigor.

Will we be updating the

Portfolio Configurator

with these new recommendations?

Yes!

What should I do if I have access to some, but not all, of the funds in the portfolio I want?

This is a common problem in 401k accounts. Sometimes, there is an option to link to a brokerage account for a larger selection of funds, but not always. Suppose your preferred portfolio is the 50|50 Worldwide Ultimate Buy and Hold, and you have very limited choices, such as with the U.S. Government’s thrift savings plan (TSP). Then, it comes down to prioritizing what’s most important to you and adjusting accordingly.

Since the TSP only offers three equity index funds that invest in stocks (C = US large-cap, S = US small-cap, I = international large-cap), and none are value funds, the choices become how much to have in small versus large and US versus international. Depending on which of these matters more to you, you’ll likely make different choices since the S (small) fund only includes US companies.

If the 50% US, 50% international split, and geographic diversification are what you prioritize, then you’ll likely put 50% into the I fund first. That leaves 50% left for US funds. You could put it all in the S fund and have a portfolio that is still half-in-large, half-in-small, half-in-US, and half-in-international, but for many, that will feel a little extreme since it foregoes the US large market altogether. Most people would probably go for still including some of the C fund and accept the differences in the large/small allocation.

If, on the other hand, size diversification is what you prioritize, then you’ll likely put 50% in the S fund first. That leaves 50% to split between the US C-Fund and the international I-Fund. Once again, you could put all of the remaining 50% into the I-fund and come closest to the WW Ultimate Buy and Hold allocation. Still, most people will probably choose something less extreme, allocating the remaining 50% to a mix of the I-Fund and the C-Fund.

Lastly, you could consider adding a value and/or small-cap value holding in another account to achieve the value tilts the TSP lacks.

Why don’t we include all-in-one funds like AVGE, multifactor funds like VFMF, or target-date funds?

It’s to keep the work manageable and the message focused and understandable.

We don’t have any recommended 1-Fund portfolios, so a fund like AVGE doesn’t fit. Our portfolios also don’t include multi-factor funds like VFMF. That doesn’t make these funds bad. It just makes them different.

Adding target-date funds sounds interesting but might not be all that actionable. Many people are limited in the choices available in their employer-provided 401k, and Vanguard is the most common offering. For now, it seems better to focus on doing a good job on ETF and mutual fund recommendations rather than expand into target-date funds.

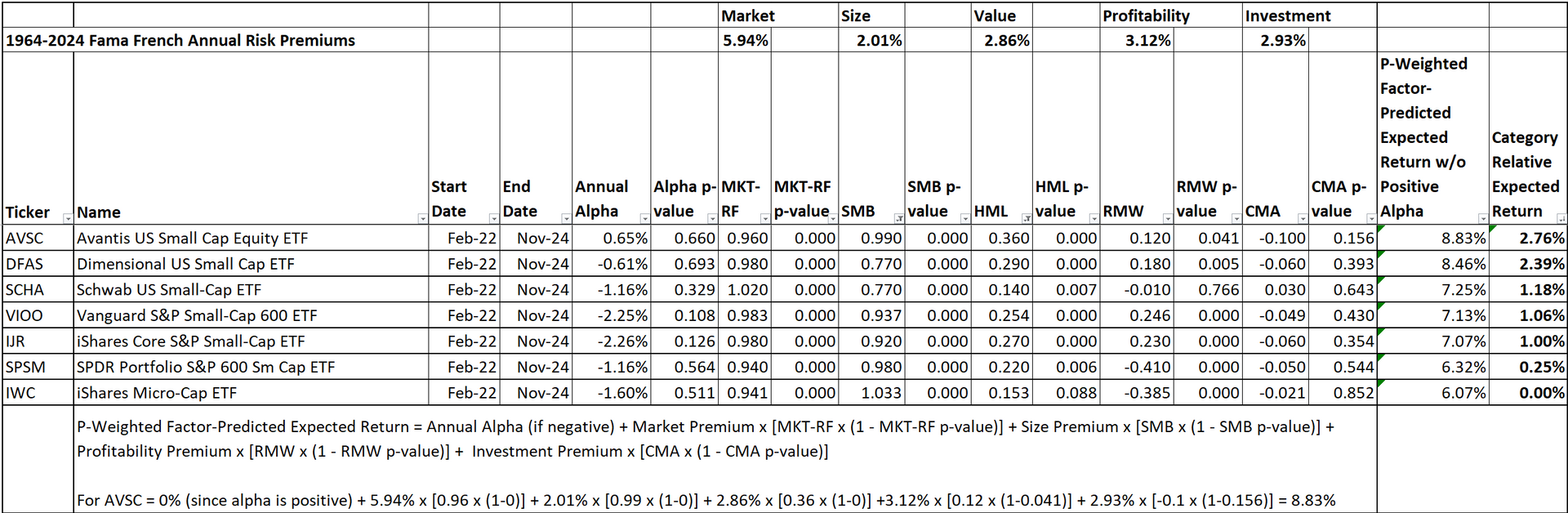

How do you calculate the factor-predicted expected relative returns?

Here’s an example from the US Small Cap Blend category using the February 2022 start date dictated by the Avantis US Small Cap Equity ETF.