Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

Why young investors should own stocks — not bonds

Reprinted courtesy of MarketWatch.com.

Published: March 26, 2025

To read the original article click here

If I could persuade young investors to do only one thing, it would be this: Invest your portfolio in stocks instead of bonds.

Of all the financial decisions you will make in your life, this one is likely to have the biggest impact.

There’s no all-purpose definition of what counts as a “young” investor. But for this discussion, that can apply to anyone with 20 or more years ahead of them.

Too many investors under age 40 seem afraid of stocks or stock funds, and some of them turn to “low risk” alternatives like bonds.

It’s undeniably true that the stock market can tumble, sometimes with little or no warning. But, as I will show with some startling data, keeping your money in the “safety” of bonds can cost you an enormous opportunity over your lifetime. I’m not kidding when I say that missed opportunity can easily be worth $10 million.

This is the second in a series of articles I think of as Investor Boot Camp 2025. In the first lesson, I showed how small changes in an equity portfolio can make major long-term differences.

Today we’ll back up a bit to focus on the reason to own stocks in the first place.

Most investors over age 50 should have a mix of both stocks and bonds. But if you expect to have 20 or more investing years ahead of you, the well-documented history of the market holds some important lessons you should know.

Here are three big ones:

- Anything can happen in the immediate future. There’s tremendous risk in owning stocks for just an hour or a day or even just one year.

- But over the past 97 years (a period for which we have reliable data), the market has always come back and exceeded its low points.

- Virtually every seasoned investor and adviser will tell you that “toughing it out” pays off in the long run.

If you are hoping that your savings today will bring you a better life in the future, you’ll have to accept the risks along the way. (In future Boot Camp articles, I’ll show how to minimize those risks.)

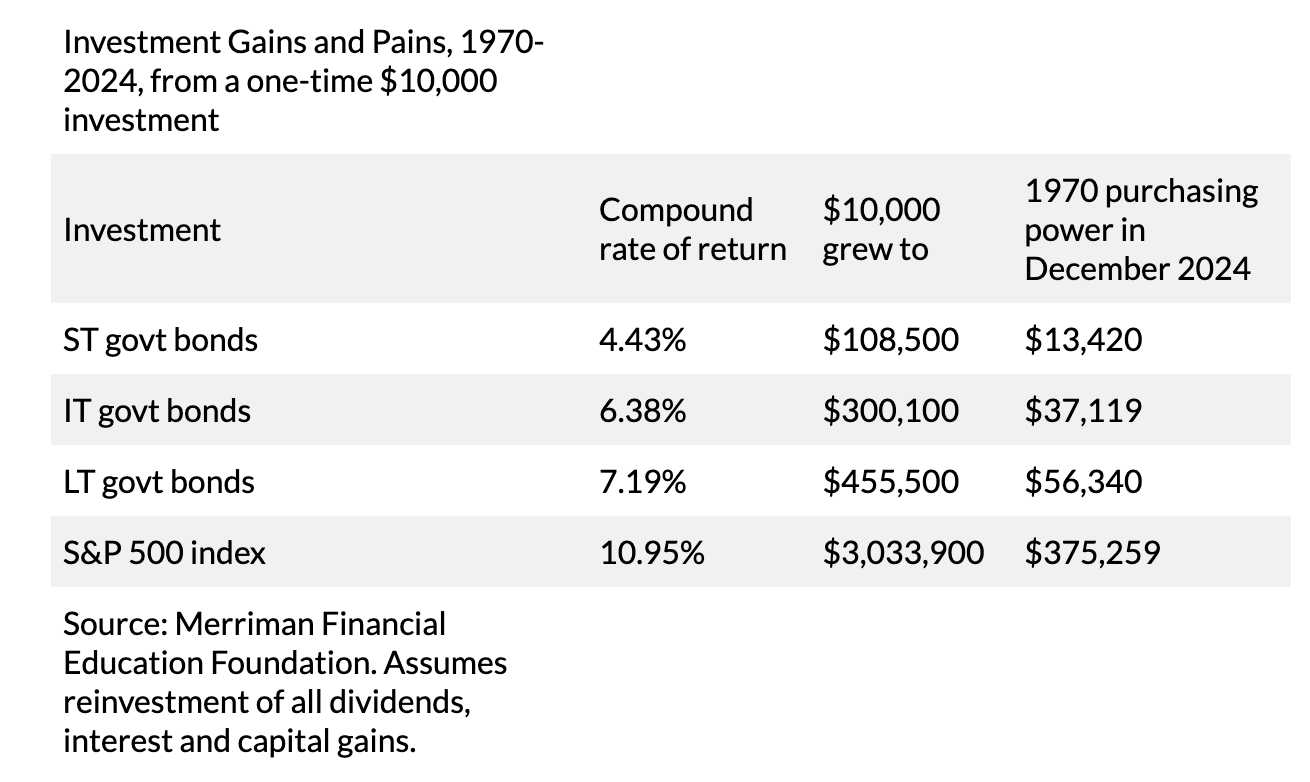

Let’s look at a simple table of numbers and compare the results of investing in “safe” government bonds with investing in the “risky” S&P 500 SPX-0.35%

.To follow the table, imagine that at the start of 1970 you and three skittish friends each invested $10,000. One friend put it all into short-term bonds; the second put it into intermediate-term bonds; the third put it into long-term bonds. Meanwhile, YOU decided to take the risk of putting your $10,000 into the S&P 500.

Your risk-averse friends certainly had many years without immediate investment pains. You, by contrast, had to endure double-digit losses in six calendar years, including a gut-wrenching drop of 37% in 2008.

Although your friends’ bond investments did manage to increase their 1970 purchasing power through 55 years of actual inflation, by the end of 2024 they had to do without anywhere from 85% (long-term bonds) to 96.4% (short-term bonds) of the gains that you achieved.

If you compute the numbers back 97 years, you’ll find a similar pattern. A $10,000 investment in long-term government bonds in 1928 gained a tiny amount of purchasing power by the end of 2024 ($1,957 to be exact). That’s something, I guess.

But with an investment in the S&P 500 instead of bonds, the purchasing power of that $10,000 would have grown to nearly $1.2 million.

I’m trying to hammer this point home like a tough, demanding coach. Remember, this is Investor Boot Camp. If you take this lesson seriously, your future self will thank you profusely.

It’s certainly fair to ask why, if this is so obvious, young people gravitate to bonds instead of stocks.

A big part of it may be what we’ve all seen: abrupt and unexpected changes in the political landscape, the fortunes of cryptocurrency, the safety of the U.S. dollar.

Investors who lived through the financial crisis of 2007-09 saw the S&P 500 decline by nearly 57%. They certainly understand the challenges of buying and holding.

And although the U.S. stock market has been mostly bullish since 2009, it’s highly likely that another serious setback (perhaps a decline of 30% to 50%) lies ahead.

For retirees and those close to retirement, that’s a compelling reason to have a portfolio that includes bonds as well as stocks.

But here’s something that’s not so obvious or intuitive: For young investors, a market downturn is an opportunity. An opportunity to buy stocks at lower prices. Yes, that feels risky. But that is how the “real” money is made in stocks: by taking risks.

Over the past half-century, I’ve seen this time after time: The long-term rewards of investing go to those who can tolerate the bumpy, uncomfortable ride along the way.

In future Boot Camp 2025 articles, I’ll discuss the best ways to accumulate money for your future life without ruining your present life. We’ll explore various ways to withdraw money when you’re ready to retire. And if your priority is to retire earlier instead of later, I’ll show you how to do that.

I’ve got more to say on this topic. You’ll find it in my podcast and separately in a video.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of “We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.”

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.