Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

Which total market fund is best for long-term investors?

Reprinted courtesy of MarketWatch.com

Published: January 14, 2025

To read the original article click here

If you own an index fund, I’m guessing you’re probably satisfied. So long as it’s a no-load index fund with low expenses, you’ll probably do fine.

But some investors — and I hear from them frequently — are intent on squeezing more performance from the U.S. stock market, without embracing either market timing or active management.

Long considered the benchmark for the U.S. stock market, the S&P 500 SPX -0.21% includes 500 of the largest and most well-established U.S. companies that are considered less risky than smaller ones. This is the route favored by Warren Buffett.But plenty of advisers and teachers advocate total market index funds, which invest in virtually all publicly traded U.S. companies, regardless of size.

J.L. Collins, author of “The Simple Path to Wealth,” favors this total market index (TMI) approach. He argues that it can take advantage of the historically higher long-term returns from value stocks and smaller companies, both midcap and (especially) small-cap.

The late John Bogle of Vanguard liked both approaches. He created the Vanguard 500 Index Fund VFIAX +1.84% and the company’s Total Stock Market Index Fund VTSAX+1.83%.

Both are popular and highly regarded, with very low expenses.

However, diversification isn’t a strong suit of either the S&P 500 or the total market index. Both are dominated by a handful of the largest companies.

The 10 largest holdings in VFIAX make up 34.8% of the fund’s assets. Nine of them are giant technology companies.

The exact same 10 holdings make up 29.7% of the portfolio in VTSAX.

Because both these funds have been available since March 31, 1993, it’s easy to compare their long-term results through both favorable and unfavorable markets.

According to Morningstar, if you invested $10,000 in each of these funds when they first were offered, with dividends and capital gains reinvested, you would have ended 2024 with $264,948 in the S&P 500 fund and $260,036 in the total market fund.

After more than 31 years, the total market index fund produced only 1.9% more money — less than $5,000 — than the S&P 500 fund. However, the difference in dollars could have mattered more to the many investors with far more money invested.

In theory, the results should have been the other way around, with the TMI’s small-cap and value exposure helping it outperform the S&P 500.

So what’s going on?

I think part of the answer is that the total market index includes small-cap growth stocks, which have historically underperformed the S&P 500 by about as much as small-cap value stocks have outperformed it.

In any case, it seems obvious to me that investors who want meaningful diversification against the S&P 500 would do well to look further.

At the risk of annoying the fans of traditional total market index funds like VTSAX, I’m going to assert that Avantis Investors has created a better solution for investors who want a total market fund that captures more of the superior returns of smaller-company stocks and value stocks.

My pick is the Avantis U.S. Equity ETF AVUS +0.08%, which has been available to investors since Sept. 30, 2019, when it was created by Eduardo Repetto, the company’s chief investment officer.Repetto’s long and successful career (including that of chief investment officer) at Dimensional Fund Advisors makes him anything but a newcomer to index funds that are based on solid academic research.

DFA is known for using quantitative models to create passive, evidence-based strategies based on the academic work of financial economists like Eugene Fama and Kenneth French. Repetto insisted (at DFA) and continues to insist (at Avantis) on avoiding stock picking. The fund follows its own proprietary index, based on clearly stated rules, not the beliefs or hunches of managers.

Nor does AVUS use market timing. Its portfolio turnover is only 1%, according to Morningstar.

The stocks in the AVUS portfolio are not as heavily cap-weighted as those in Vanguard’s VTSAX. That means giant technology names like Google GOOG -1.30%, Apple

AAPL -4.04% and Microsoft MSFT -0.41% don’t dominate the portfolio quite as much.According to Morningstar, an initial investment in AVUS on its opening date in 2019, with dividends and capital gains reinvested, would have produced a cumulative gain of 96.9% by the end of 2024.

Because AVUS is an ETF, it’s best compared with Vanguard’s Total Stock Market Index ETF VTI -0.07%. In that same period, the cumulative gain for VTI was 91.9%.Although that outperformance by AVUS is far from spectacular, it occurred during a period that was unusually kind to the large-cap stocks that dominate Vanguard’s total market index.

Obviously, results going back only to 2019 aren’t especially meaningful to long-term investors, and AVUS won’t be every investor’s cup of tea.

If you’re satisfied with the relatively modest diversification you get in VTSAX or its twin VTI, that’s fine.

But if you believe, as I do, that smaller stocks and value stocks will continue to outpace large-cap blend over the very long term, AVUS is a total-market fund that emphasizes those parts of the market.

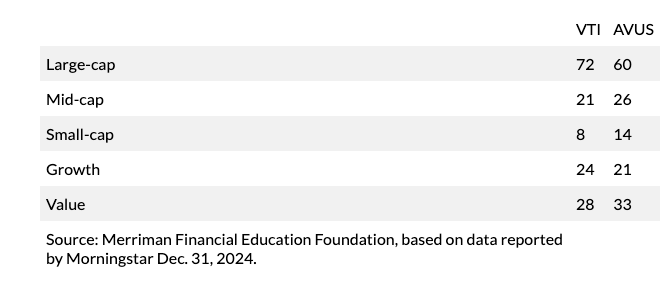

Portfolio percentage weights in two total-market ETFs

Though the percentage differences are not large, AVUS has more of its portfolio in higher-performing asset classes.

Over the coming decades, I believe the premium returns for mid-cap, small-cap and value stocks will reassert themselves. And I believe the differences you see in that table could very well mean an additional 1% in annual return for AVUS investors.

Over a lifetime to a typical investor, that can easily be worth an extra $1 million.

For a deeper dive into how the market has U.S. stock market has worked over the past 96 years, you’ll find a good discussion and some colorful graphics in The Inside Story on the Merriman Quilt Charts.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of “We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.”

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.