Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

This is the best way to invest for retirement

Reprinted courtesy of MarketWatch.com

Published: April 11, 2023

To read the original article click here

Dear readers: Every year since 1995 I have described what I believe is the very best way for long-term investors to build an equity portfolio.

This article is Part 1 of a series intended to give do-it-yourself investors what they need to be successful without relying on expensive managers or trying to outguess and beat the market.

Increasingly, I have been telling people they should think of investing as a journey rather than a series of events. This is the first phase of that journey.

Let’s start by taking off the gloves.

Too many investors are following outdated advice that keeps them from achieving the returns they could have, while saddling themselves with unnecessary risks and losses.

Sixty years ago, medical experts believed — and preached — some things we now know are dead wrong:

- “Smoking is good for you.” Doctors appeared in cigarette advertisements, not realizing they were encouraging a major cause of cancer, heart disease and strokes.

- “The more protein, the better.” Nope. We know now that excess protein can damage our kidneys.

- “Humans need lots of rest.” Now we understand that active lifestyles promote longer and healthier lives; ironically, too much rest can be harmful.

When I first got into the investment business 60 years ago, most people “knew” you needed to own only 10 to 20 individual stocks of “good” companies that you would keep, essentially forever.

Later, investment experts “wised up” and started recommending owning the 500 companies in the S&P 500 SPX, -0.41%. By the 1990s, many people thought that was all they would ever need.

But just like medical professionals, we investors now have a lot more tools available to achieve more of what we want (higher long-term returns) and less of what we don’t want (anguish and losses).

Academic researchers are in near-total agreement that diversification is about the only “free lunch” Wall Street has to offer. They have identified nine equity asset classes that have solid long-term records of being good diversifiers when combined with the S&P 500, which is a “blend” of growth stocks and value stocks.

Here are those nine: U.S. large-cap value stocks, U.S. small-cap blend stocks, U.S. small-cap value stocks, real-estate investment trusts, international large-cap blend stocks, international large-cap value stocks, international small-cap blend stocks, international small-cap value stocks, and emerging markets stocks.

I have no idea which of these asset classes will do best or worst in any given period. I don’t need to know that. For nearly 30 years I have advocated owning equal portions of all of them, in a combination I have referred to as The Ultimate Buy and Hold Strategy.

On our foundation’s website you can find a pair of tables, one showing how each of these building blocks has enhanced the long-term performance of the S&P 500 over the past 53 calendar years, the second showing how this portfolio is built, step by step.

Let’s look at some of what you will find there.

Because we’re talking about 53 years, the numbers are very big. Take them with a grain of salt because they are not adjusted for inflation and, just as important, the future won’t be just like the past.

An initial investment of $100,000 in the S&P 500 at the start of 1970 would have grown to $18.9 million by the end of 2022. That’s certainly a “wow” number, and it’s a good base for comparisons.

By contrast, a portfolio made up of equal parts of that index plus the nine asset classes I listed above, with annual rebalancing, would have grown to $41.8 million.

That’s the long-term power of diversification. And it’s readily available through exchange-traded funds that we have identified as the best of the bunch.

This 10-fund strategy does not require you to look into the future or pick managers or sectors or companies. It does not require you to figure out when to get in and out of the market.

What it DOES require is lots of patience and a hands-off approach. If you meddle with it, it won’t work as expected.

The big problem with looking at past returns is that we know how things turned out in the end. It’s easy to “take a risk” that way. But as human beings we must live in the present, without knowing the future.

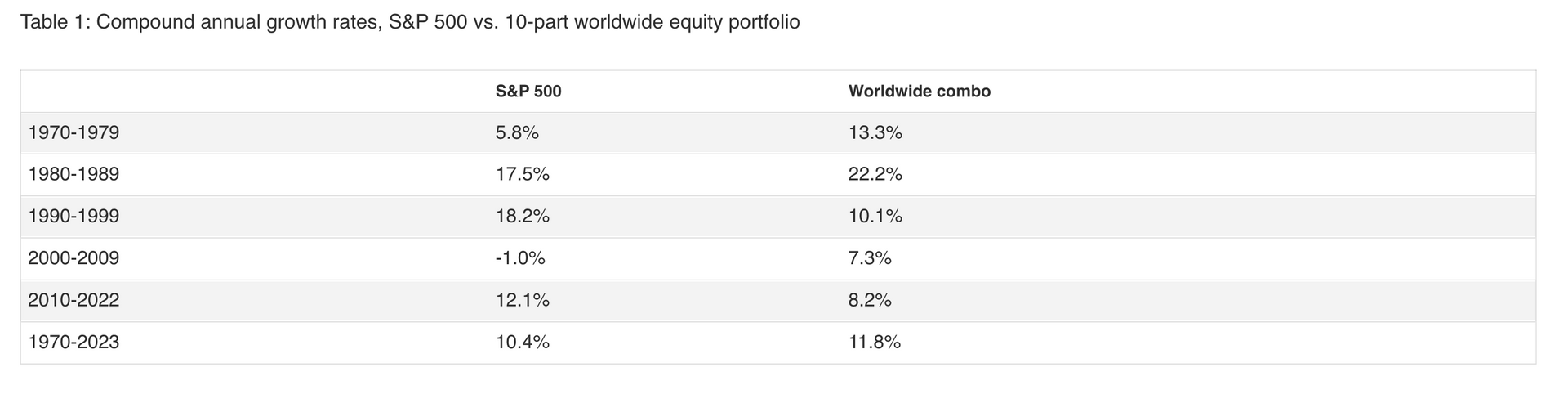

At the Merriman Financial Education Foundation, we computed compound returns one decade at a time. Some of the differences deserve your full attention.

Table 1: Compound annual growth rates, S&P 500 vs. 10-part worldwide equity portfolio

If you started investing in 1970, after 10 years you could have been forgiven if you decided to go all-in with the worldwide portfolio.

But the 1990s presented a very different story. By 2000, many investors were convinced the S&P 500 was all they ever needed.

Then two major bear markets struck, leaving the S&P 500 with a money-losing decade from 2000 through 2009. Anyone who retired in 1999 or 2000 and relied exclusively on the that index would have found the first decade of this century extremely painful.

(It’s another topic altogether, but that is one reason I always urge people to do their best to retire with more assets than they think they’ll ever need.)

The last line in the table shows that a high level of diversification worked remarkably well over the very long haul.

However, owning and managing 10 asset classes is too much for most investors. That’s the bad news.

The good news is that Chris Pedersen, director of research at our foundation, has developed a series of simpler portfolios that are much easier to live with. Every one of them greatly improved on the long-term performance of the S&P 500.

That will be the topic in my next article in this series.

For more on this “ultimate” 10-part portfolio, I’ve recorded a video and, separately, a podcast.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of We’re Talking Millions! 12 Simple Ways To Supercharge Your Retirement.

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.