Our Mission: Empower Do-It-Yourself Investors with Free Academic-based Research & Resources for Life-long Investing

These small changes could boost your investment gains by millions of dollars

Reprinted courtesy of MarketWatch.com.

Published: February 26, 2025

To read the original article click here

If you asked 1,000 investors what equity asset class they would choose to own for life, if they could choose only one, most of them (perhaps 95%) would likely name either the S&P 500 index or the Total Market Index.

That’s not a bad answer. But based on more than half a century of real-life investment returns, it’s far from the best answer.

The best answer to a lifetime equity portfolio isn’t just my opinion. It’s the result of thousands (probably tens of thousands) of hours of academic research into what really works. And it boils down to a simple formula:

Start with the S&P 500 SPX -0.25%, then add thousands more stocks through index funds that diversify into other asset classes. If you do it right, this massive diversification will bring higher long-term returns along with lower risks.The best thing about this formula is that you can get impressive improvements by taking only baby steps, dipping your toes into the water, so to speak. You don’t have to stray far from the familiar comfort of the S&P 500 or the Total Market Index SPTMI -0.23%.

In this article, I’m going to point the way to that best answer and introduce you to Investor Boot Camp 2025, it’s an annual series I’ve done since 2023 that include topics such as how to control your level of risk and safely plan for taking money out of your portfolio when you retire.

It won’t surprise you to learn that most investors want more than anything else to make as much money as they can. The problem is that this goal often leads to risky investments that, when they go south, lead people to bail out.

According to academic research, the most important thing for long-term investing success is to avoid that panic — to stay the course.

Fortunately, as you’re about to see, you can get higher long-term returns than those of the S&P 500 — along with less short-term volatility so you’ll be able to stay the course.

When I say higher returns I am not talking about nickels and dimes. I’m talking about potentially millions of extra dollars over a lifetime.

As we dive in, I want to get one thing out the way up front: the difference between the S&P 500, which contains 500 large-cap U.S. stocks, and the Total Market Index, or TMI, which tracks the wider equity market and includes large-, mid-, small-, and microcap stocks. That difference is not very significant, and much less worthy of your time than what I’m about to show you.

In a recent article on TMI funds, I compared the results of Vanguard’s TMI (VTI) and S&P 500 index (SPX) funds from 1993 through 2024 and found that the TMI fund produced only 1.9% more money.

Instead, focus on the following. If you invested a lump sum of $100,000 in the S&P 500 in 1970 and reinvested all dividends and capital gains, you would have ended 2024 with nearly $29.9 million. That’s impressive.

Even more impressive: Imagine that you had left 90% of the money in the S&P 500 and put the other 10% into large-cap value stocks. By the end of 2024, your additional gain (over and above what you got from having 100% in the S&P 500) would have been nearly $2.2 million. That’s an extra gain worth about 22 times your total original investment.

You would have achieved that from a change in only 10% of your portfolio.

Had you taken one more baby step with another 10% of your portfolio, investing 80% in the S&P 500, 10% in large-cap value and 10% in a small-cap blend index, your additional gain would have been about 39 times your original $100,000 investment.

And your portfolio would still have experienced less risk than the S&P 500 by itself.

At the Merriman Financial Education Foundation, we have calculated the hypothetical results of four more small steps you could have taken, each one backed by lots of academic research.

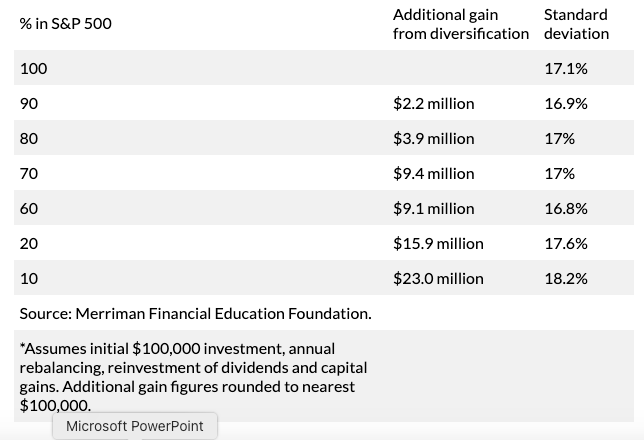

Here is a simple table that shows these six steps and their hypothetical results through 2024. It’s important to note that these numbers aren’t meant to suggest what you will achieve, but they do show what’s possible from small incremental changes in a portfolio.

Results of adding asset classes to S&P 500 index, 1970-2024*

The line showing 70% in the S&P 500 contains 10% each in U.S. large-cap value, U.S. small-cap blend and U.S. small-cap value. The next line moves another 10% into real-estate investment trusts. The next-to-last step puts 10% each into four international asset classes: large-cap blend (comparable to the S&P 500 in the U.S.), large-cap value, small-cap blend, and small-cap value. The final step adds 10% in emerging markets.

Here’s something for statistical nerds: By the time you get to the last two steps, you can see that the “risk” measured by standard deviation takes a jump.

If that makes you nervous, it shouldn’t. That’s because standard deviation is calculated in a way that makes above-average returns seem equally risky as below-average returns. So that 18.2% figure reflects a “happy” outcome rather than a “dangerous” one.

This nine-step diversification plan is something I’ve been talking and writing about since 1995, when I first described it as The Ultimate Buy and Hold Strategy. I still think it’s worthy of that description, but in practice it is too cumbersome for most individual investors because it requires owning, monitoring and rebalancing 10 funds.

Instead, I recommend you invest for very similar results from owning as few as two funds.

In Boot Camp 2025, I’ll show you how.

If you want to learn more, here are three useful resources:

- First, a table containing the underlying data I referenced above.

- Second, a podcast to go with this article: The Ultimate Buy and Hold Strategy Update 2025.

- Third, a video presentation with the same title.

Next in Investor Boot Camp 2025: The most important investment decision of your life: stocks vs. bonds.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of “We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.”

Delivery Method. Paul Merriman will send stories to MarketWatch editors on a biweekly basis. Licensor may republish such stories 24 hours after publication on MarketWatch with the attribution.

The Merriman Financial Education Foundation is a registered 501(c)(3) organization founded in 2012.

All donations are used to support our work. Deductions are permissible to the extent of the law.

Contact us at info@paulmerriman.com

All information on this site is provided free of charge (with the exception of books for sale) and is funded in full by The Merriman Financial Education Foundation.

Anyone wishing to use this educational information in web-based or printed materials are welcome to do so with the following attribution and link:

“This information freely provided courtesy of PaulMerriman.com.” We would also appreciate a copy and link of where it has been published via email.

All Rights Reserved