Driven To Find Solutions: an interview with Chris Pedersen

By Chris PedersenIntroduction

Target date funds (TDFs) are so compelling that they now capture over half of all new retirement program contributions. It’s easy to see why. They’re simple, automatic and cheap. You select the fund closest to your retirement year and it automatically invests in a broadly diversified, age-appropriate set of assets that shift over time. What could be better? As it turns out, quite a lot, and in this article, we’ll show you some simple choices that could result in 20% to 100% more in retirement.

Why Target Date Funds?

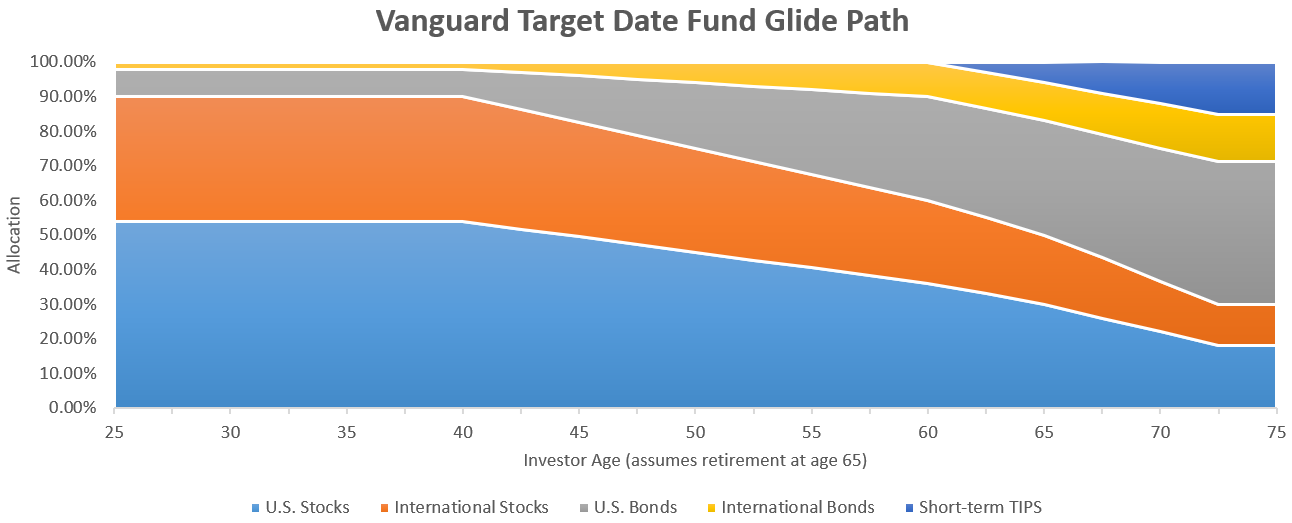

Our risk tolerance as investors declines with age. When we are young, time is on our side and we can handle more risk. We have decades to save, decades to invest, and little to lose. Nearing retirement, things reverse and we become risk-averse. Target date funds strive to match that changing risk tolerance by shifting from riskier assets in the early years to less risky assets in the later ones. This time-varying asset allocation is called the glide path. Here’s the Vanguard Target Retirement Fund glide path.

At first glance, it looks like it’s doing what it’s supposed to. By steadily increasing the bonds from age 40 to age 65 volatility is declining nearing retirement. As we look closer though, things start to become puzzling. For example, why have bonds at all from age 25 to 40? Aren’t these our most risk-tolerant years? Similarly, why not have more high risk-reward assets like small, value and emerging markets in those early years? Here’s a quote from Vanguard’s approach to target date funds that helps explain:

“If maximization of wealth is the primary goal, then a higher equity allocation would be an appropriate strategy. However, this does not account for the downside risk that investors would need to withstand … on a short-term basis .”

Rather than optimizing for maximum wealth, they’ve chosen to be more conservative, even in the early years, to reduce short-term downside risks. Presumably, this is because they think it will keep investors from panic selling. Perhaps this is necessary in a one-size-fits-all solution, but as we’ll see, the short-term downside risks for young investors are not that great, and much higher expected returns are possible by having more of the portfolio in equities in the early years.

Do target date funds lower risk with age like they say they do?

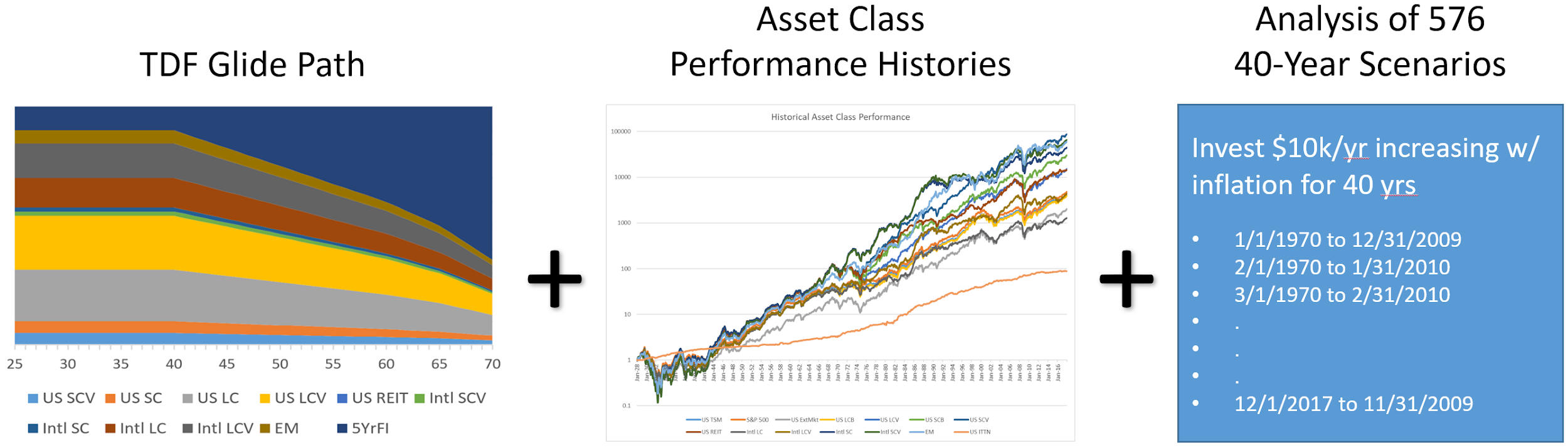

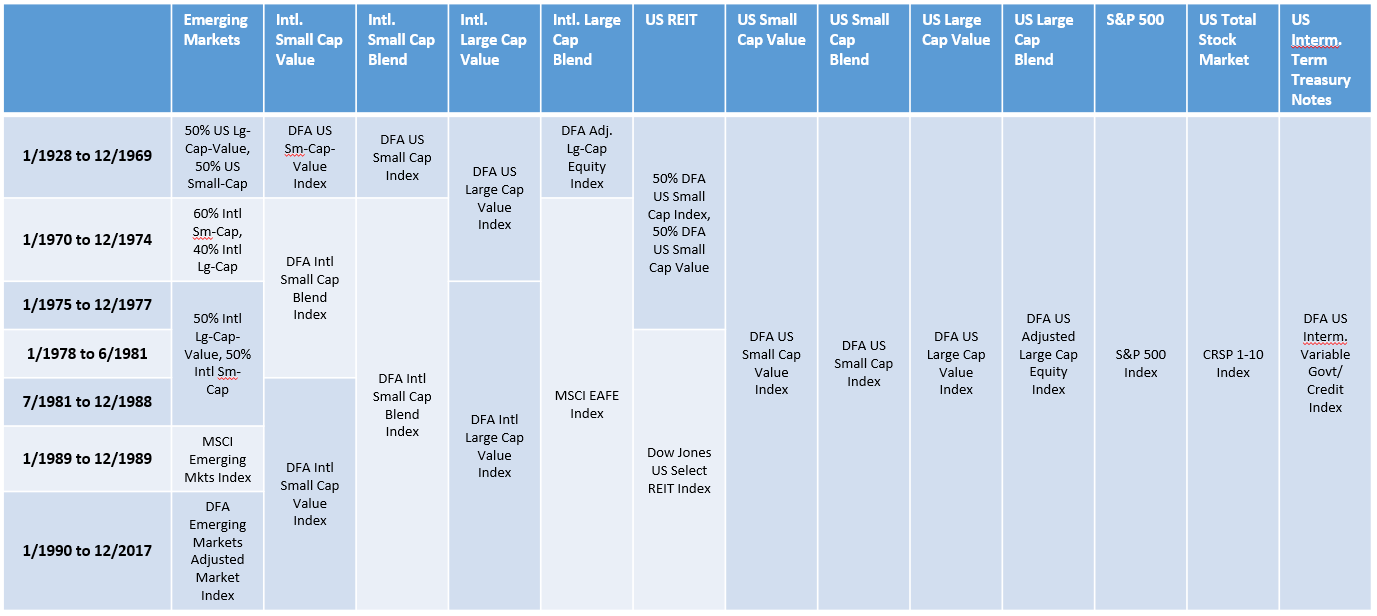

To find out whether target date funds do what they say, we built a backtesting spreadsheet to test different glide paths and asset combinations for every starting month going back to 1970. That’s 576 different overlapping time periods. We also used substitute asset classes to extend the analysis back to 1928. To make sure every phase of the glide path is tested for every month, we used circular bootstrapping. This means we circle back to the beginning year returns when we run out of return data. For example, if we were examining only 10 years of history and started in year #8, the years 8, 9 and 10 would be followed by 1, 2, 3, and so forth.

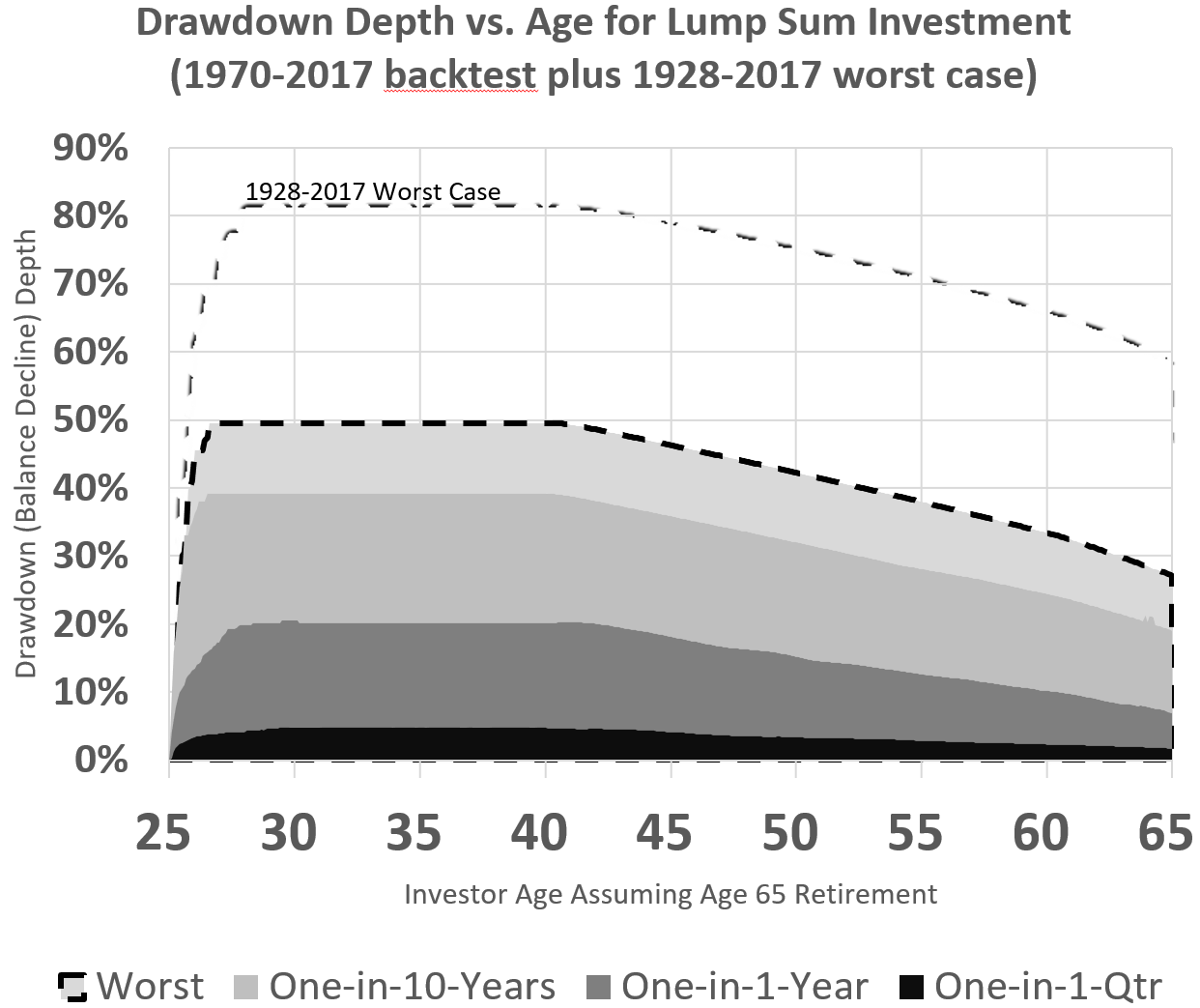

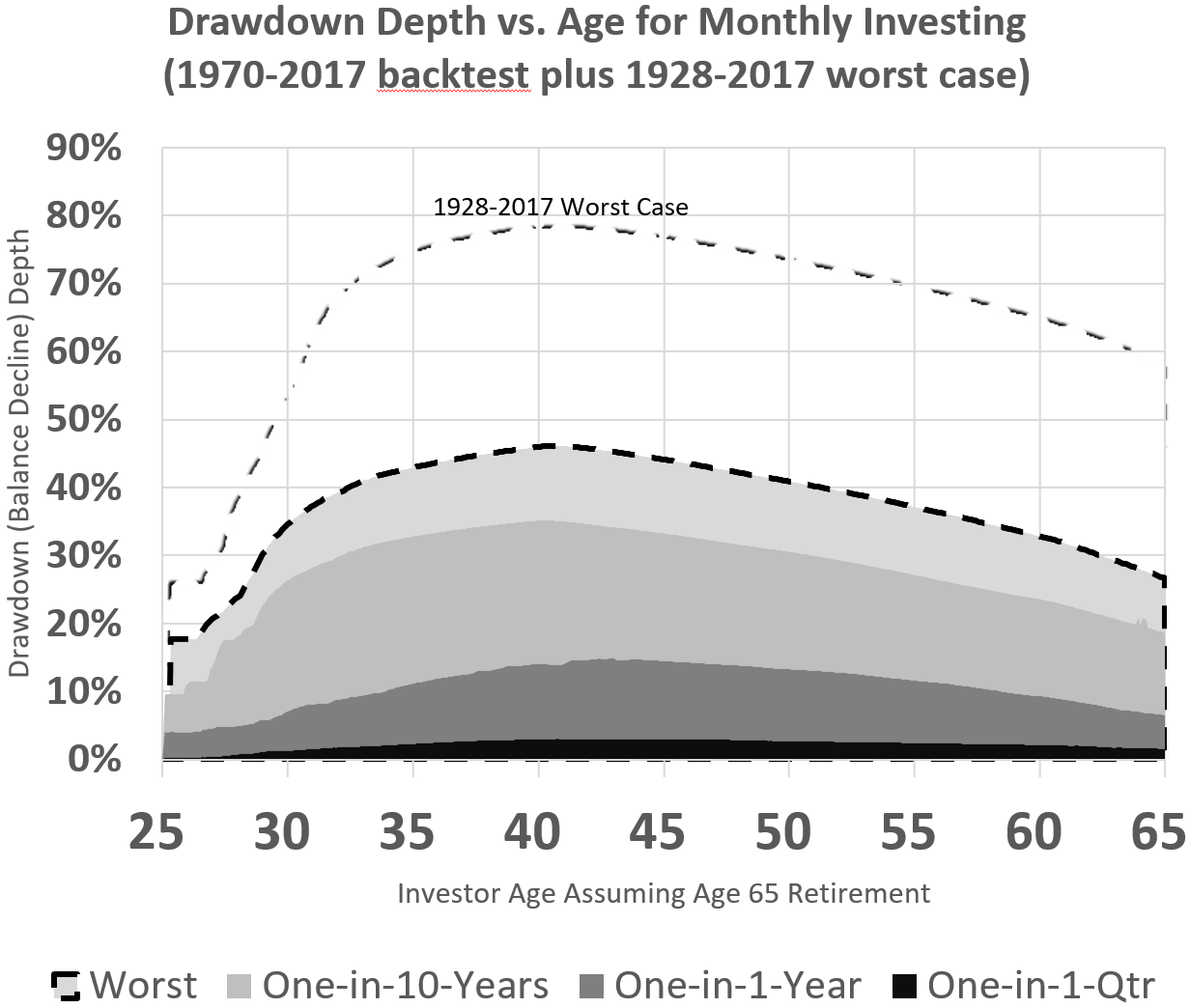

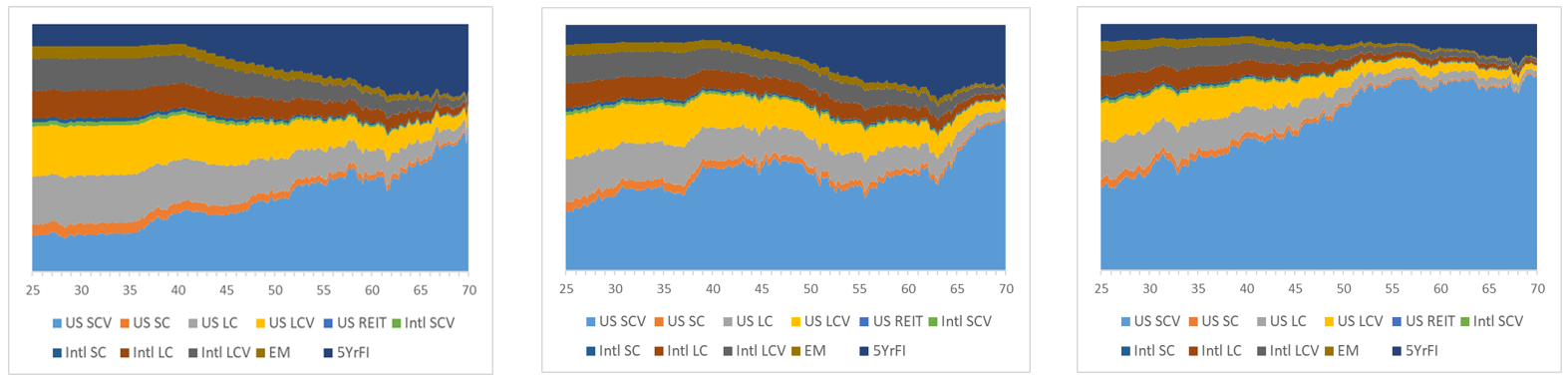

When we run different combinations of asset class funds and investment assumptions through the analysis, we learn things such as the average end balance, the range of end balances, the depth of drawdowns (balance declines) that are likely in a quarter/year/decade or lifetime, the frequency and magnitude of the approach beating a baseline reference investment and more. The baseline reference we chose was the Vanguard Target Retirement Funds which we approximated with equity and fixed income asset glide path allocations in what we call “Vanguard-Like Target Date Fund.” Here are the drawdown curves for two scenarios using the Vanguard-Like TDF. The one on the left assumes a lump-sum investment, and the one on the right assumes regular investing starting at $0.

The lump sum investment chart makes it look like the glide path is doing what it’s supposed to. Risk starts high, then declines starting at age 40 when more bonds are being added to the fund. The reality is almost no one saves for retirement in a lump sum. Most people start with nothing and set a little aside every month until they retire. If we look at the drawdown risks for a monthly investor starting at $0 and contributing the same amount every month, we see much lower drawdown risks in the early years. The reason the monthly investor with a small balance sees smaller drawdowns is that they’re continuously contributing amounts that are large relative to the balance. It’s not that they don’t experience the negative returns, but it’s harder for them to see them since the account balance is always going up. Not only do regular contributions raise the balance, but dollar-cost averaging further reduces risk by buying more shares when the market is down and fewer shares when the market is up. Ironically, most target date fund investors will see lower drawdown risks in their first five years of investing than they will approaching retirement. This argues even more strongly against bonds in the early years of a glide path.

Including bonds in the early years is almost certainly keeping investors from achieving the long term return they can achieve with very little additional risk, but that underperformance is small compared to adding one or more of a handful of asset classes that have a very long history of higher returns. The rest of this study compares the risk and return of the traditional single TDF with TDF-plus one or more of the remarkable asset classes investors should consider adding to their portfolio.

TDF-Plus Strategies

If we take the Vanguard Target Retirement fund to be the baseline, what could we add to it or replace it with for better performance? We’ve evaluated many options and selected an illustrative set to share.

For Investors who want to invest a set percentage in multiple funds over a lifetime without rebalancing

- 90% Vanguard-Like TDF and 10% Small-Cap-Value fund

- 80% Vanguard-Like TDF and 20% Small-Cap-Value fund

- 70% Vanguard-Like TDF and 30% Small-Cap-Value fund

For investors with better choices in their 401k who can rebalance regularly to lower risk over time

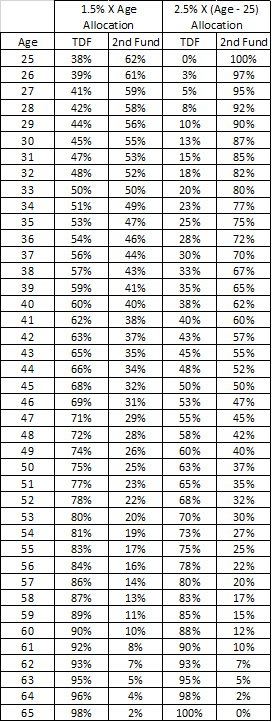

- 1.5% X Age in TDF plus rest in Large-Cap-Value

- 1.5% X Age in TDF plus rest in Small-Cap

- 1.5% X Age in TDF plus rest split between Large-Cap-Value and Small-Cap-Value

- 1.5% X Age in TDF plus rest in Small-Cap-Value

- 2.5% X (Age - 25) in TDF plus rest in Small-Cap-Value

For investors who are willing to take the simple steps of periodically changing the percentages invested in the TDF and other asset class (classes), as well as periodically rebalancing the funds

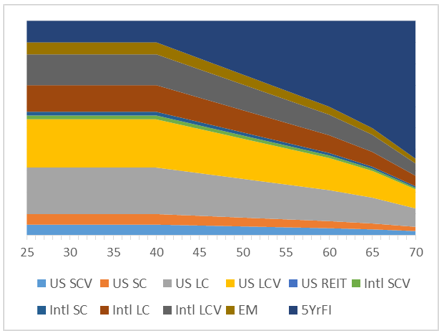

- Merriman aggressive TDF that emphasizes small-cap-value and emerging markets early on

Several of the examples are age-scaled so risk of losses (drawdowns) still decline with age. For example, the 1.5% X Age in TDF approaches would imply having about 40% in a TDF and 60% in a second asset class at age 26, but by age 66.7 you would have 100% in the TDF.

Backtest Assumptions & Results

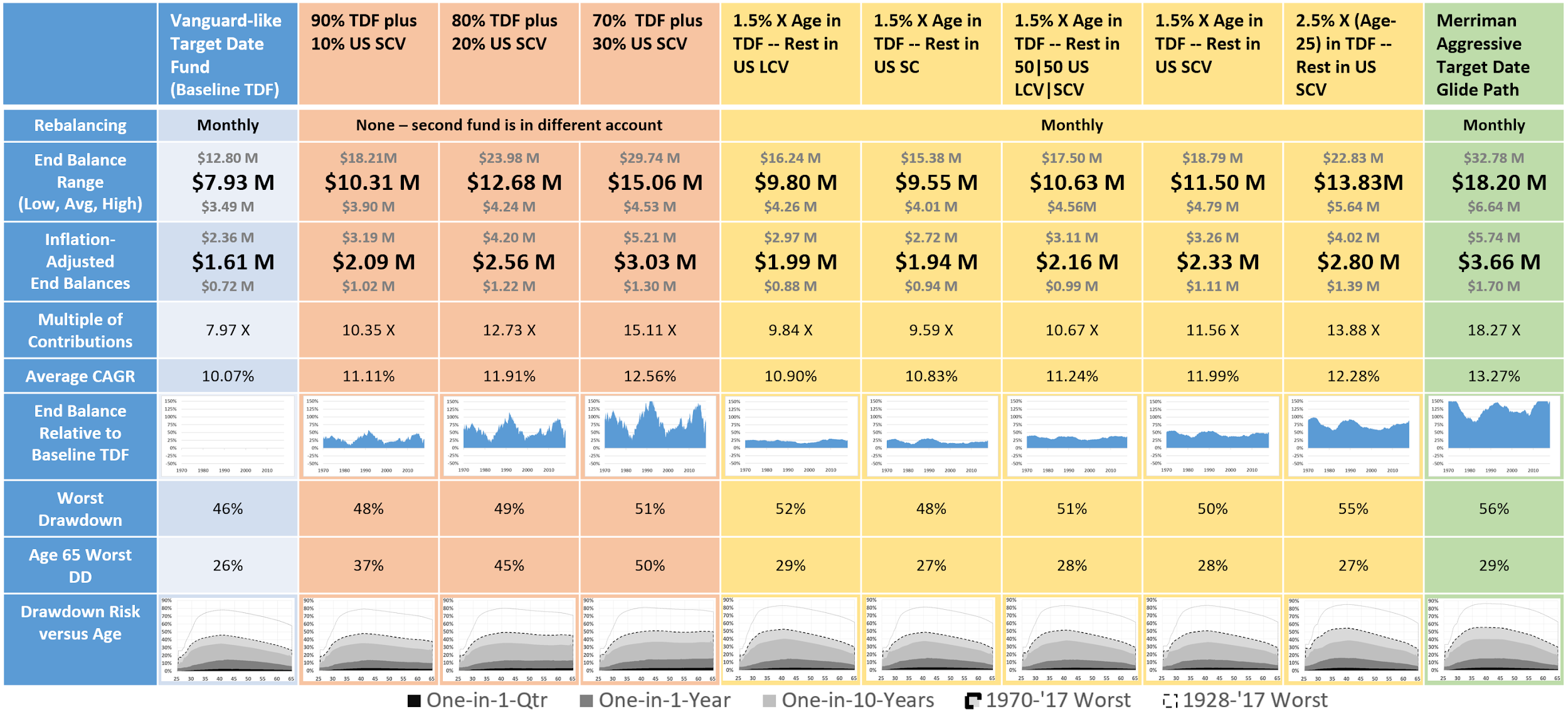

The table on the next page summarizes the backtest findings. Here are the underlying assumptions used in the testing.

- All scenarios assume $833/month (~$10k/yr) is invested for 40 years increasing with inflation.

- The low, average and high end balances are the worst, average and best outcomes.

- The inflation-adjusted row shows the end-balances less inflation.

- The multiple of contributions row is the average end-balance divided by the average contributions (~$996k). The minimum total contribution was $757k and maximum was $1,330k.

- Average CAGR is the average Compound Annual Growth Rate over all 40 year periods.

- End-balance relative to baseline TDF shows performance relative to the baseline for all time periods.

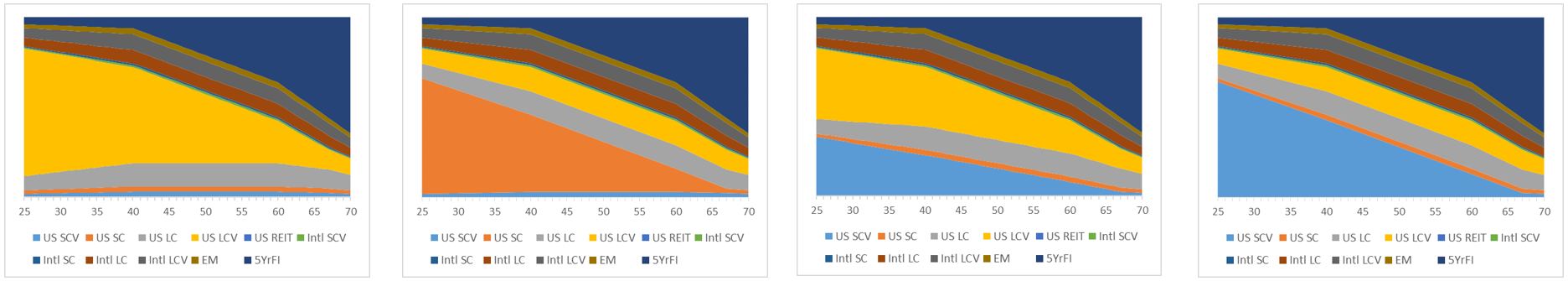

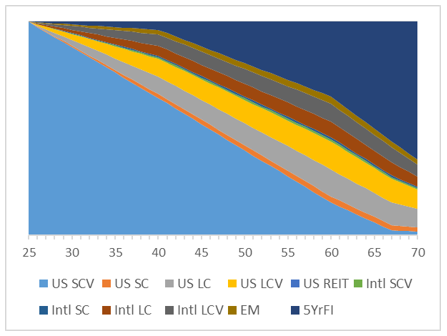

- Drawdown risk vs. time shows how balance decline risk varies with age. Darker areas represent more likely or frequent drawdowns. The dashed lines represent the worst-case drawdowns for a 1928 to 2017 backtest using proxy asset class data.

So, what do we learn? Quite a lot!

- Target date funds are definitely not optimized for maximizing wealth. All of the TDF-Plus approaches had higher average end balances with no lower worst-case end-balances. Increases range from 20% to >100% and add from $1.6M to >$10M.

- The higher end balances were historically reliable. All TDF-Plus approaches beat the baseline Vanguard-like target date fund for every one of the 576 overlapping 1970 to 2017 time frames.

- Higher end balances are earned by tolerating slightly deeper drawdowns along the way. The Vanguard-like TDF had a worst drawdown of 46% while the two-fund solution worst drawdowns range from 48% to 56%.

- Drawdowns can be much worse. The 1928 to 2017 drawdowns using proxy asset class data show worst-case drawdowns of 78-87%. But again, tolerating the 1 to 9% higher short-term drawdowns would have been rewarded with significantly higher end-balances 99% of the time.

- Not rebalancing raises end balances and risk nearing retirement. Investors who choose this approach out of necessity or inclination should prepare for a major loss that could be suffered at or near retirement.

- Age-based allocations are an effective way to augment a TDF without raising risk substantially nearing retirement. All of the age-based allocation scenarios have drawdown risks at age 65 that are within three percentage points of the Vanguard-like TDF by itself.

- It’s almost impossible to have high drawdown risk in the first 5 years of investing. The benefits of regular contributions and dollar-cost averaging greatly reduce the depth of drawdowns compared to what a lump-sum investor would experience.

- Just saving for retirement is not enough. Look at the multiple of contributions row which shows the number of ending-dollars for every dollar invested. The various investment approaches deliver 8 to 18 times more money than would have resulted from just saving without an investment return. Without taking some prudent risk through investing, the end balances would been very small by comparison and difficult for anyone to retire on comfortably.

- The most aggressive approach was the least risky in the long run. The Merriman Aggressive TDF Glide Path had the highest average return and lowest down-side risk (low end balance). The short-term drawdowns are higher, but history suggests tolerating them will likely be worth it.

- Luck matters. Looking at the end-balance relative to baseline TDF charts it’s clear that the advantage of any given approach varies significantly with good or bad luck timing.

- There’s no risk in the past, and there are no guarantees in the future. The past is only an indicator, but in this case, it’s a loud one. When every single historical period shows an advantage to an approach, it probably warrants consideration.

Recommendations!

First, if you’re a young investor, recognize that your portfolio is resilient because you have a small balance and are constantly investing more money. You have time on your side and are likely to do well if you contribute regularly, and stick to a plan.

Second, recognize that TDFs are often more optimized to limit short-term balance declines than to maximize long-term returns. If that’s what you need, they may be perfect, but if you can weather the short-term declines, adding a second fund could lead to having much more in retirement.

Third, consider the TDF-Plus strategies described above and see which might be best for you. Hopefully, there’s enough information to help you make an informed decision based on your circumstances and temperament.

Fourth, If you really like the idea of a custom-made plan built to provide diversification and emphasis on higher early risk for better returns, look into the Merriman Aggressive TDF allocations available in a customizable Google Sheet at www.paulmerriman.com (customizable once you create a copy into your own Google Drive). The Merriman Aggressive TDF allocations are also available as pre-configured M1 Pies at the bottom of the article about M1 Finance also on Paul’s website..

Lastly, remember that the results shown in this study are from the past. Even though the past i our best indicator of what’s to come, there are no guarantees that the future will be the same. Be aware that there are likely to be many years, even a decade or more, where these approaches do not match or beat the S&P 500.

Disclaimer

We do not render personalized investment advice. This article provides general investment guidance on the investment philosophy of Paul Merriman (writing as Paul A. Merriman) with supporting work done by Chris Pedersen.

This article contains data gathered from sources that are believed to be reliable. However, we can make no representations as to their accuracy or completeness. This article is not intended to offer specific investment, accounting, legal or tax advice to any individual investor. Paul Merriman, or the others mentioned on this website, do not render or offer to render personalized investment advice or financial planning advice through this website.

APPENDIX

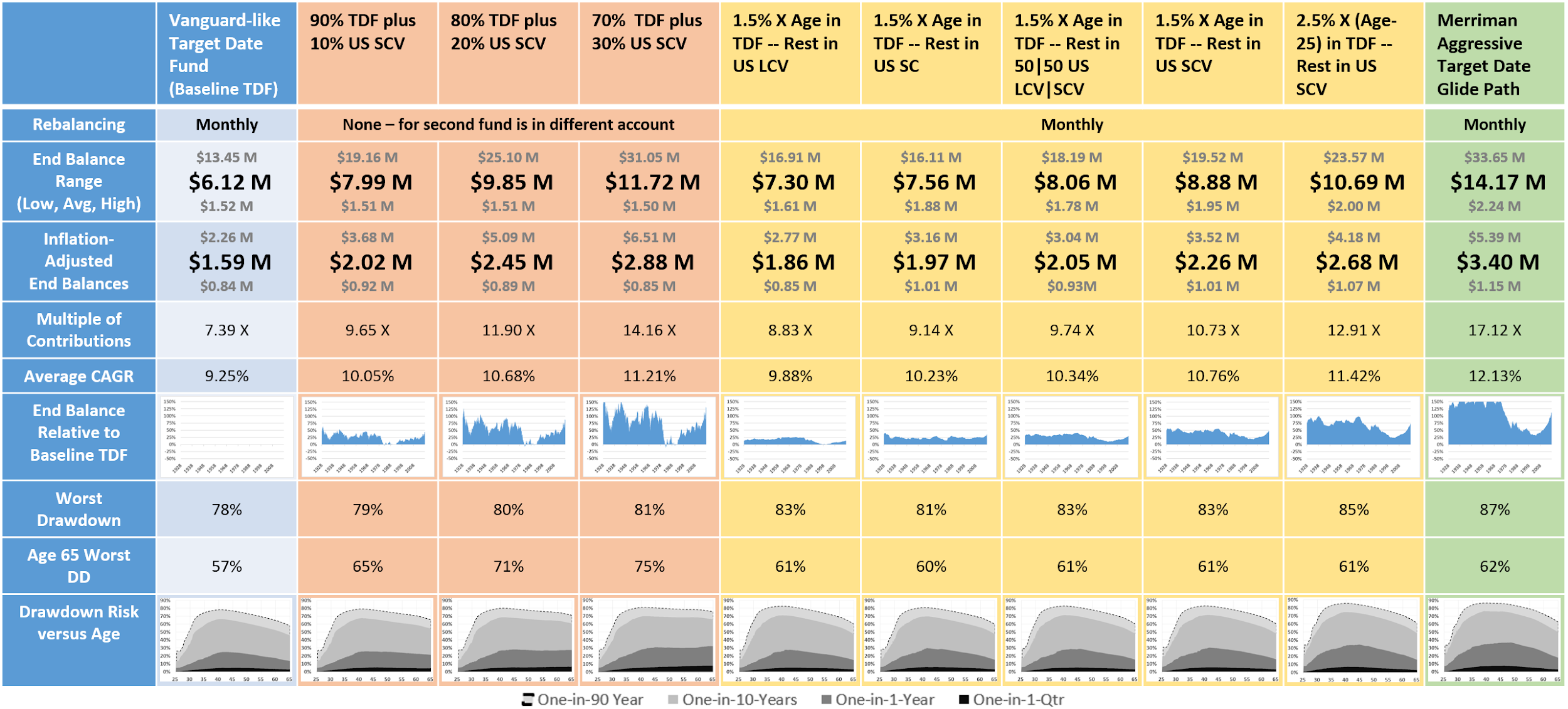

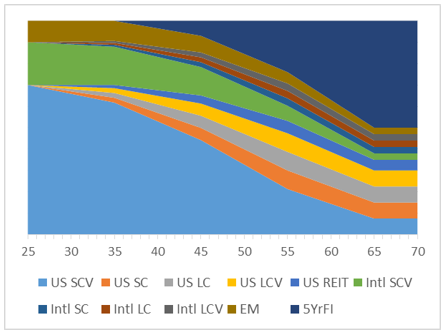

What about 1928?

We chose to focus on the 1970 to 2017 period for the article because it’s where we have the best data. Having said that, we also analyzed back to 1928 using substitute asset class histories to see what we’d find. Here’s the result:

Not surprisingly, drawdown depths are much greater throughout the glide path. At age 65, the worst drawdown depths range from 57% to 62% which is more than double that of the 1970 to 2017 history. The absolute worst drawdowns are even higher ranging from 78% to 87%. It appears when times get really bad, everything goes down more.

Getting past the deep drawdowns, how did the alternative portfolios perform compared to the baseline target date fund on its own? Look at the end balance relative to baseline TDF row. For the 1080 overlapping 40 year periods, there are short time frames where the alternative two-fund solutions only matched the baseline TDF or underperformed it slightly, but only very slightly. For the vast majority of time frames, the two fund solutions out-performed the baseline TDF-only approach and often by a lot .

Other than validating our earlier conclusions, this data drives home the point that we need to find an investing approach we can stick with through the very toughest of tough times. Even though drawdowns were much deeper, investors who stuck with the plan still ended up with 7 to 17 times what they saved.

Glide Paths Vanguard-like TDF Glide Path

Un-Rebalanced TDF + SCV Glide Paths (90/10, 80/20, 70/30) Examples -- allocation fluctuates

1.5% X Age in TDF Glide Paths (US LCV, US SC, US LCV & SCV, US SCV)

2.5% X (Age - 25) in TDF -- Rest in SCV Glide Path

Merriman Aggressive Target Date Fund Glide Path

Back-tested Scenario Parameters 576 overlapping 40-year (age 25-65) sequences tested using 1970 - 2017 historical returns 1,080 overlapping 40-year (age 25-65) sequences tested using 1928 - 2017 historical returns Circular bootstrapping used to ensure all years see all phases of each glide path. Monthly investments of $833 increasing with inflation applied for all but lump-sum investing scenarios Monthly returns, contributions, fees & rebalance applied at end of each month Drawdowns from peak measured before contribution 0.16% Expense ratio used for all funds except for second-bucket SCV which used 0.25%

The Merriman Financial Education Foundation is a registered 501(c)(3) organization founded in 2012.

All donations are used to support our work. Deductions are permissible to the extent of the law.

Contact us at info@paulmerriman.com

All information on this site is provided free of charge (with the exception of books for sale) and is funded in full by The Merriman Financial Education Foundation.

Anyone wishing to use this educational information in web-based or printed materials are welcome to do so with the following attribution and link:

“This information freely provided courtesy of PaulMerriman.com.” We would also appreciate a copy and link of where it has been published via email.

All Rights Reserved