(Updated March 2023)

By Chris Pedersen

What are the best ETFs to use to implement our recommended portfolios?

Whatever asset allocation you choose, you’ll also need to choose particular funds to invest in. This article provides a set of recommendations to simplify that process. We’ve also updated Paul’s M1 Finance Pies and the Portfolio Configurator with these new recommendations.

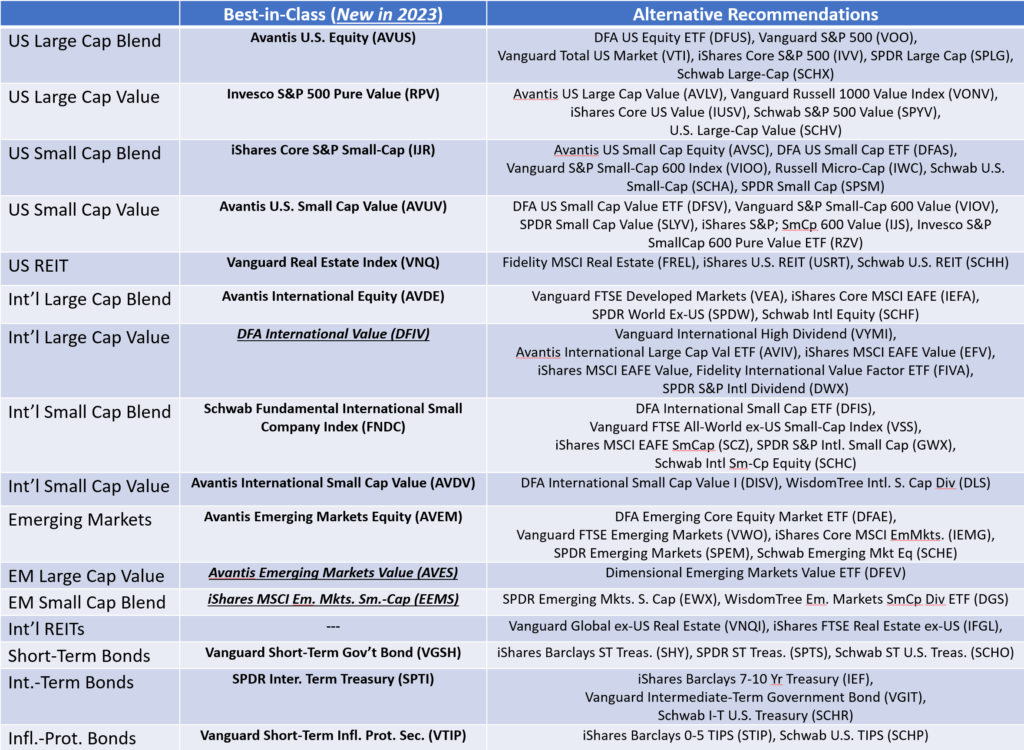

What do we mean by “best?” Obviously, keeping expenses low is a priority, but our portfolios are based on academic research that says there have been higher returns in smaller and more value-oriented equities. Those higher returns have come with higher volatility, but by combining several different asset classes that don’t always move together, a higher return per unit of risk is possible. We look for low-cost, broadly-diversified ETFs in each asset class which together consistently produce tilts towards small and value. After screening thousands, and analyzing hundreds of ETFs, here are our new best-in-class recommendations and a set of alternatives for those of you who don’t have access to the best-in-class choices.

There are three changes this year.

- We’ve replaced the iShares MSCI EAFE Value (EFV) fund with the Dimensional International Value ETF (DFIV) since it has a lower expense ratio, lower annual turnover, deeper value orientation, and smaller company size. It’s been more volatile but has also had a higher long-term return and return per unit of risk. There is also a long return history based on the predecessor mutual fund (DFIVX).

- We’ve added the Avantis Emerging Markets Value ETF (AVES). Although its track record is short, it has provided meaningful exposure to the value part of emerging markets with an emphasis on quality companies such that it has the highest factor-predicted return of all the Emerging Markets funds we analyzed.

- We’ve moved the iShares MSCI Emerging Markets Small Cap ETF (EEMS) from the alternative recommendations to the best-in-class recommendations for Emerging Markets small-cap.

Here’s how those changes impact our recommended portfolios compared to the all-Vanguard (low-cost) reference, DFA reference, and 2021 BIC ETF reference portfolios.

Should you switch to the new recommendations?

This is something only you can decide. If your funds are in taxable accounts, you should consider the tax implications of selling the old funds vs. the potential benefits of the new ones. If your funds are in tax-deferred accounts, the taxes don’t matter, but your confidence in the recommendations does. If you believe the new recommendations will serve you better based on the rationale given and any additional research you do, then go ahead and switch. In the end, it’s probably more important that you have an investment strategy you believe in and can stick with than that you have exactly the right funds for that strategy.

Will we be updating the ETF custom allocation calculator with these new recommendations?

The ETF custom allocation calculator has been replaced with the Portfolio Configurator. If you use the ETF custom allocation calculator in your own Google Drive account, you can update it with the new recommendations though and continue to use it on your own.

What should I do if I have access to some, but not all, of the funds in the portfolio I want?

This is a common problem in 401k accounts. Sometimes, there is an option to link to a brokerage account for a larger selection of funds, but not always. Suppose your preferred portfolio is the 50|50 Worldwide Ultimate Buy and Hold, and you have very limited choices, such as with the U.S. Government’s thrift savings plan (TSP). Then, it comes down to prioritizing what’s most important to you and adjusting accordingly.

Since the TSP only offers three equity index funds that invest in stocks (C = US large-cap, S = US small-cap, I = international large-cap), and none are value funds, the choices become how much to have in small versus large and US versus international. Depending on which of these matters more to you, you’ll likely make different choices since the S (small) fund only includes US companies.

If the 50% US, 50% international split, and geographic diversification are what you prioritize, then you’ll likely put 50% into the I fund first. That leaves 50% left for US funds. You could put it all in the S fund and have a portfolio that is still half-in-large, half-in-small, half-in-US, and half-in-international, but for many, that will feel a little extreme since it foregoes the US large market altogether. Most people would probably go for still including some of the C fund and accept the differences in the large/small allocation.

If, on the other hand, size diversification is what you prioritize, then you’ll likely put 50% in the S fund first. That leaves 50% to split between the US C-Fund and the international I-Fund. Once again, you could put all of the remaining 50% into the I-fund and come closest to the WW Ultimate Buy and Hold allocation. Still, most people will probably choose something less extreme, allocating the remaining 50% to a mix of the I-Fund and the C-Fund.

In either situation, adding a value and/or small-cap value holding in another account could help to achieve the value tilts that the TSP lacks.

Why don’t we include all-in-one funds like AVGE, multifactor funds like VFMF, or target-date funds?

It’s to keep the work manageable and keep the message focused and understandable.

We don’t have any recommended 1-Fund portfolios, so a fund like AVGE doesn’t fit. We also don’t have a spot for a multi-factor fund like VFMF in our portfolios. That doesn’t make these funds bad. It just makes them different. AVGE provides some of the qualities of the Ultimate Buy and Hold portfolio in a single fund, but it’s not as “valuey” or small as the portfolios we recommend. VFMF actually has a comparable to slightly higher factor-predicted return and higher historical return per unit of risk than RPV. But it’s an actively managed factor fund, not a large-cap value fund.

Adding target-date funds sounds interesting but might not be all that actionable. Many people are limited to the choices available in their employer-provided 401k, and Vanguard is the most-common offering. For now, it seems better to focus on doing a good job on ETF and mutual fund recommendations rather than expand into target-date funds.

The Merriman Financial Education Foundation is a registered 501(c)(3) organization founded in 2012.

All donations are used to support our work. Deductions are permissible to the extent of the law.

Contact us at info@paulmerriman.com

All information on this site is provided free of charge (with the exception of books for sale) and is funded in full by The Merriman Financial Education Foundation.

Anyone wishing to use this educational information in web-based or printed materials are welcome to do so with the following attribution and link:

“This information freely provided courtesy of PaulMerriman.com.” We would also appreciate a copy and link of where it has been published via email.

All Rights Reserved